There's a common misconception that agencies looking to sell must be weak. Even people who should know better assume that anyone selling now must be desperate. Well, there are desperate sellers out there, but we're not entertaining them. We like strength and, there are a few super-strong shops seeking a sale at the moment. We'd be lucky to welcome any of them into the group.

There's a common misconception that agencies looking to sell must be weak. Even people who should know better assume that anyone selling now must be desperate. Well, there are desperate sellers out there, but we're not entertaining them. We like strength and, there are a few super-strong shops seeking a sale at the moment. We'd be lucky to welcome any of them into the group.

How we see things

.jpg?width=400&height=242&name=1657803835-covid-globe%20(1).jpg)

Almost every marketing agency has caught the Coronavirus. The health of an agency now, in the seventh month of our self-imposed business trauma, depends on four things:

- Exposure to vulnerable client sectors

- Balance sheet strength

- Management action

- Mindset

Some client sectors shut down very early on; travel, leisure, events and entertainment come to mind. But other sectors have shown great resilience despite the fervour with which some businesses bailed on their marketing partners.

Almost all agencies felt the shock of lockdown and those with strong balance sheets, with at least three months' working capital in cash - but probably more - are emerging with strength in tact.

How quickly management reacted to circumstances, how ready they were to take painful action early and how in touch they were with client needs seem also to be an indicator of Q4 strength.

Don't underestimate the importance of mindset. A team that feels "it's not worth fighting" will not fight. Whereas, those that are determined to overcome any obstacle, usually find a way. We've seen extraordinary efforts by some agencies with super-profitable and successful adaptations to redefine their businesses. You can't pivot core competence, but the best of the best have innovated superbly since March.

Value always costs real cash

When we analyse the agency market, we apply an M&A lens because we’re actively looking for new acquisitions year-round. We undertook the basic segmentation explained below from this point of view. Our analysis shows that there’s everything to be optimistic about in the future.

The 'experts' tell you: “there are great bargains to be had in tough times”. We think this is a massive over-simplification. Barring the odd lucky break, value must always be paid for. How it’s paid and when it's paid for are the key issues. But, it does always end up costing real cash.

Anyone that tells you otherwise is either lucky, not in the M&A business or trying to sell you something.

The market is buoyant

Despite economic gloom in the media, we’re finding the M&A market buoyant at the moment. We’re seeing lots of agencies across the communications and promotional mix exploring options as part of a strategic planning process. Some will doubtless want or need to sell because of the Covid crisis. But the real crackers always have options.

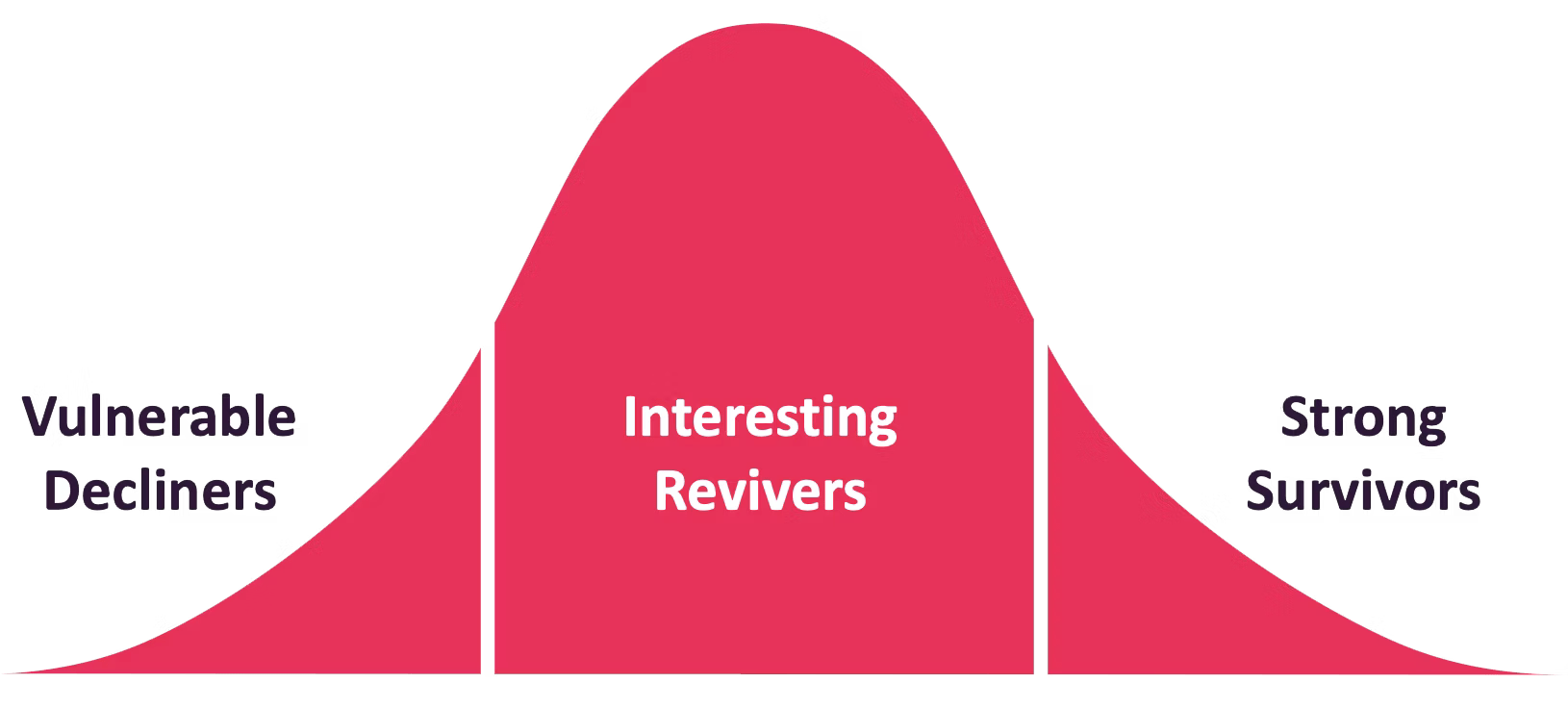

We’re very active at the moment and we’re meeting some truly quality agencies to talk about the future. The agencies we’re seeing generally fall into one of three main segments.

- Strong Survivors

- Interesting Revivers

- Vulnerable Decliners

Figure 1: Simple market model

Strong Survivors

In a segment we call ‘Strong Survivors’ we find agencies that had the management, client list and cash reserves in place to weather the worst of the lockdown. All three factors were important, but clients – or more particularly client sectors – were the key to a year that didn’t disappoint.

Strong Survivors have typically seen revenues dented by 10-20%, but prudent management and early action to control fixed costs and wages meant 2020’s bottom line isn’t far off 2019.

Strong Survivors have maintained staff cost at 55%-60% of net revenues and have cut fixed costs by: reaching an accommodation with landlords, reducing travel and entertainment and by restricting other outgoings to essentials only. Agencies may have increased spending on tech and home office equipment to enable efficient home-working, but spending has been contained.

Strong Survivors emerge from the first six months of lockdown with their goodwill in tact and while net current assets might be a little depleted, most still sit on good cash balances.

Interesting Revivers

A majority of agencies are in a segment we call “Interesting Revivers”. These agencies have either been more exposed to sectors that have cut dramatically, or their management didn’t act hard or fast enough to keep costs in line with revenues. This segment has seen revenues reduced from 20% to 50% and profits have fallen commensurately.

Interesting Revivers will almost certainly have taken advantage of furlough, but because they had cash reserves, they are still resilient. Most will have reduced staff costs to within the critical KPI range of 55%-60% and many will already have seen new briefs appearing.

Interesting Reviver agencies emerge from the first six months operating on reduced everything, including profits. But, critically and differentiating themselves from our final segment, they are still profitable. In our eyes, this means their good will still retains value and can be capitalised on as volumes increase.

Vulnerable Decliners

Finally, there are a smaller number of agencies in a segment we call “Vulnerable Decliners”. These firms had neither cash reserves nor resilient clients and they are still suffering badly. They have no cash runway and when furlough ends in full, their future is in serious doubt.

Listeners to our podcast will have heard Paul Winterflood from Moore Kingston Smith advise agencies to keep at least three months’ cash flow in working capital. Having a buffer is essential in such uncertain times and as regional and local lockdowns are re-implemented through Autumn/Winter 2020, cash reserves may be the deciding factor on whether agencies sink or swim.

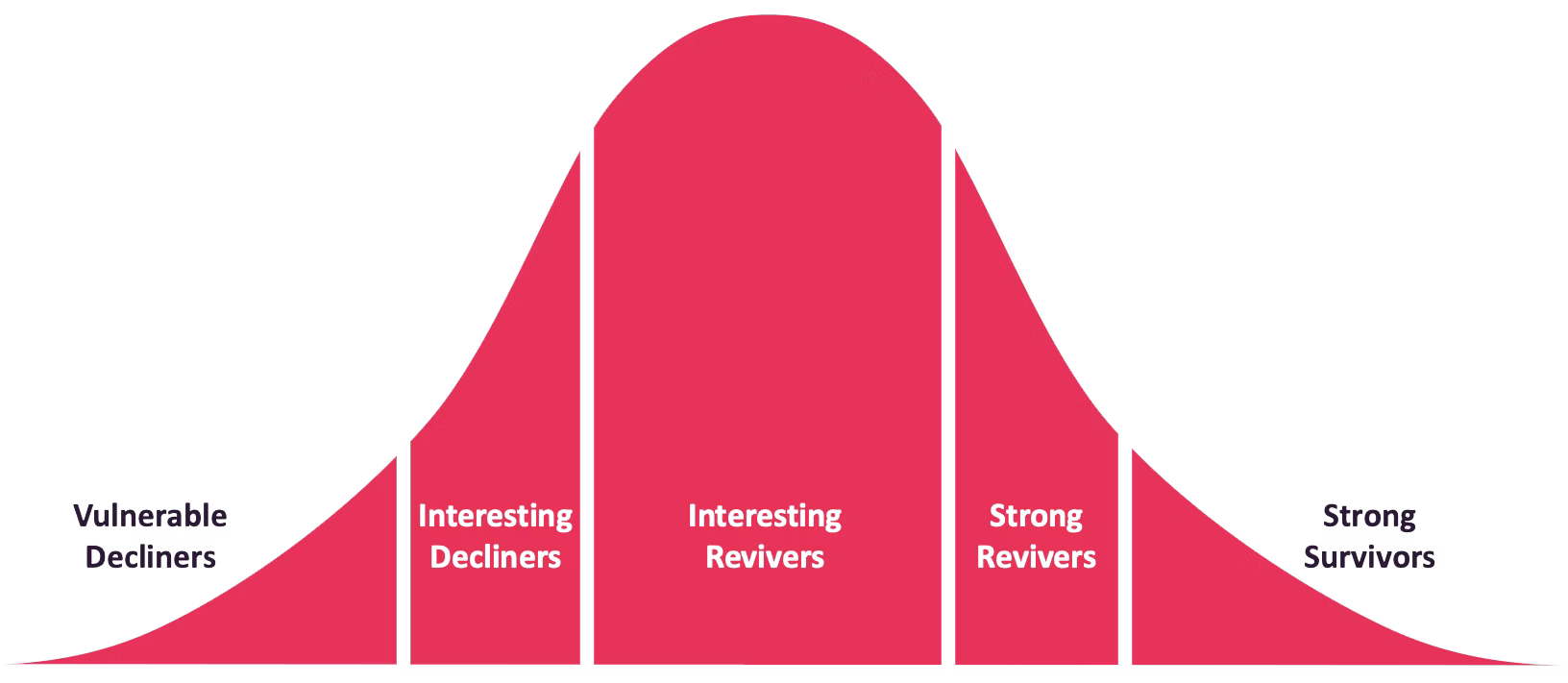

Figure 2: Full market model

This model of the market is a little simplistic, but it is broadly what we're seeing. When looking at deal structuring, we use a further two segments which are amalgams of the main three. The model then looks like figure 2 which gives scope for more variety in deal structuring.

Vulnerable Decliners are, in our opinion, the sole preserve of turnaround specialists. Interesting Decliners, however, may be able to bring long-term value to our group if the interesting bit is interesting enough. Such deals can be structured to be largely back-ended to align risk and reward for all parties.

Similarly, Strong Revivers bring strength, albeit temporarily diminished, and the ability to bounce back fast. Strong Revivers may need to be flexible about how closing considerations are financed, but there are good value-rewarding deals and structures available for those that back themselves to recover fast.

How are we using our own market map?

We’re actively targeting Strong Survivors, Strong Revivers and Interesting Revivers. The first delivers positive cash flow and the other two, the opportunity of a strong rebound once we get to the other side of this crisis.

Our model is proving attractive to quality agencies and we’re accelerating our acquisition plans.

We have a simple maxim that guides our early "go/no go" decision. We are only deploying cash acquiring agencies that have positive cash flow. Like everyone else in the sector, we need to preserve our treasury and while we’re active, we’re building a great big ship, not operating a venture fund. Others may find value in Rapid Decliners, but turnarounds require specialist skills that we neither have nor want to possess.

A note on our segments

The above is an explanation and segmentation of the small and medium sized creative agency market (15-50 people) as we are seeing it. Our evidence is observation and anecdotal and is not quantitative so is not necessarily representative. But, it does concur with the findings of consultants, business brokers, marketing leaders and other market experts we speak to regularly. Since September, we’ve looked at around 30 creative agencies which is what we’ve based this analysis on.

If you have a different view, we’d love to hear it? Please contact us directly through this website or pick up the phone. We’re publishing our view to seek those of others, but also to help agency owners get a view of what an acquirer like Selbey Anderson sees when it looks at them.